2023 Annual Conference

Now in its 11th year, The Clearing House Annual Conference has developed a reputation as the “go to” conference on banking and payments issues. We’re looking forward to another successful forum this year with C-suite industry executives, policy makers and banking experts.

You’ll be part of a unique gathering of senior level bank executives from around the country addressing today's strategic issues and opportunities for the nation’s financial institutions. The program is comprised of two days of thoughtful, in-depth remarks from high-level speakers and expert panelists in addition to informal dialogue opportunities through several built-in networking opportunities.

Check back to this site as the program fills out.

Dress Code

The event dress is Business Attire.

The Clearing House

The Clearing House is the nation’s most experienced payments company, providing secure and reliable systems and innovative solutions as well as strategic advocacy and thought leadership on critical issues for financial institutions. It operates U.S.-based payments networks that clear and settle more than $2 trillion each day through wire, ACH, check image, and real-time payments.

Participation at the Conference

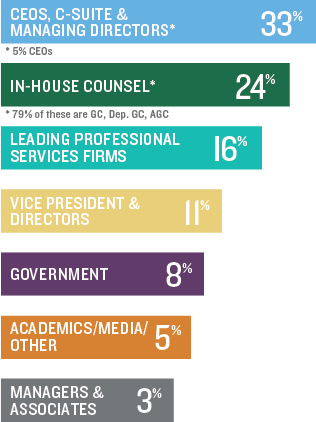

Executive Level Participation at the 2022 Annual Conference

Over 500 Executives in Attendance From the Nation's Leading Financial Institutions, Regulatory Agencies, and Professional Services Firms.

2022 Attending Firms

- ACI Worldwide

- Ally Financial

- Alston & Bird LLP

- AT&T

- Bank of America

- Bank of New York Mellon

- Bank of Tokyo-Mitsubishi

- Bank of the West

- Barclays

- BBVA

- BlackRock

- BMO Financial Group

- BNP Paribas

- Brookings Institute

- Buckley Sandler LLP

- Capital One

- CFPB

- Chain Bridge Partners, LLC

- CIBC

- CIT

- Citigroup, Inc.

- Citizens Financial Group, Inc.

- City National Bank

- Cleary Gottlieb Steen & Hamilton LLP

- Comerica

- Consumer Bankers Association

- Covington & Burling LLP

- Credit Suisse AG

- Davis Polk & Wardwell LLP

- Debevoise & Plimpton LLP

- Dechert LLP

- Deloitte Consulting LLP

- Deutsche Bank

- EBA Clearing

- ECCHO

- Empire National Bank

- Ernst & Young LLP

- Federal Deposit Insurance Corporation

- Federal Financial Analytics

- Federal Home Loan Banks

- Federal Reserve

- Fifth Third Bank

- FinCEN

- First Niagara Bank

- Fiserv

- Fitzpatrick, Cella, Harper & Scinto LLP

- Georgetown University Law Center

- Goldman Sachs

- HSBC

- IBM

- Institute of International Bankers

- JPMorgan Chase & Co.

- Kearney

- KeyBank

- KPMG LLP

- Mastercard

- Mayer Brown

- M&T Bank

- McKinsey & Company

- Moody’s Analytics

- Moore & Van Allen PLLC

- Morgan, Lewis & Bockius LLP

- Morgan Stanley

- Morrison & Foerster LLP

- MUFG Union Bank

- NACHA

- Novantas LLC

- OCC

- Oliver Wyman

- Oxford Economics

- The PNC Financial Services Group

- Popular, Inc.

- PwC

- Promontory Financial Group, an IBM Company

- Putnam Investments

- RBS

- Regions

- Santander

- SEC

- SEI

- Shearman & Sterling LLP

- SIFMA

- State Street Corporation

- Sullivan & Cromwell LLP

- SWIFT

- Synchrony

- TD Bank

- Treliant Risk Advisors

- Truist Financial Corporation

- UBS AG

- University of California

- Haas School of Business

- Unisys

- U.S. Bancorp

- U.S. Department of the Treasury

- Venable LLP

- Verizon Communications

- Verafin

- VocaLink

- Wachtell, Lipton, Rosen & Katz

- Weil, Gotshal & Manges LLP

- WilmerHale

- Zions Bancorporation